Thriving in uncertain markets: Essential market intelligence strategies for Private Equity

Recent reports indicate that while Private Equity deal volumes are showing signs of rebounding from historic lows, we remain far from the stability of previous years. This continued investment environment is driving uncertainty, making every potential deal difficult to navigate.

In this challenging environment, making value-driving investments requires firms to rethink their approach from deal origination to portfolio management. Teams must be equipped with fast, accurate, comprehensive and proprietary market intelligence to swiftly identify and seize the right opportunities—or decisively pass on those that don’t meet the mark. At the same time, there’s a renewed scrutiny on portfolio performance driving the need for rigorous strategies to unlock growth and mitigate risks.

Based on Azurite Consulting’s deep experience supplying actionable business intelligence on PE timelines, we’ve identified three essential market intelligence strategies to enable top mid-market and large cap firms:

- Know when to lean in or go pencils down on potential deals.

- Uncover, unlock and capture hidden value within their existing portfolio.

Understand the Potential of Untapped and Competitive Segments

Leading research doesn’t cut corners even when decision makers are too difficult to reach. Instead, it meticulously captures data from the entire addressable market to uncover, evaluate and size a broad set of opportunities and to validate and enrich an investment thesis.

The best way to ensure a comprehensive perspective? By talking to a comprehensive pool of potential buyers—from soon-to-be adopters to competitors’ customers—building their perspectives into your growth hypotheses, market sizing, and, ultimately, valuation. This will enable you to measure:

- How your target or portfolio company’s sweet spot varies by industry, customer type, or other relevant factors.

- How to incentivize companies that still rely on homebuilt solutions to come on board.

At Azurite, we call this capturing the “Voice of the Total Addressable Market”—and we’ve seen it drive deals forward and drive portfolio value creation – arming firms with powerful insights and trustworthy data.

Measure Market Intelligence From the Ground Up, in Granular Detail

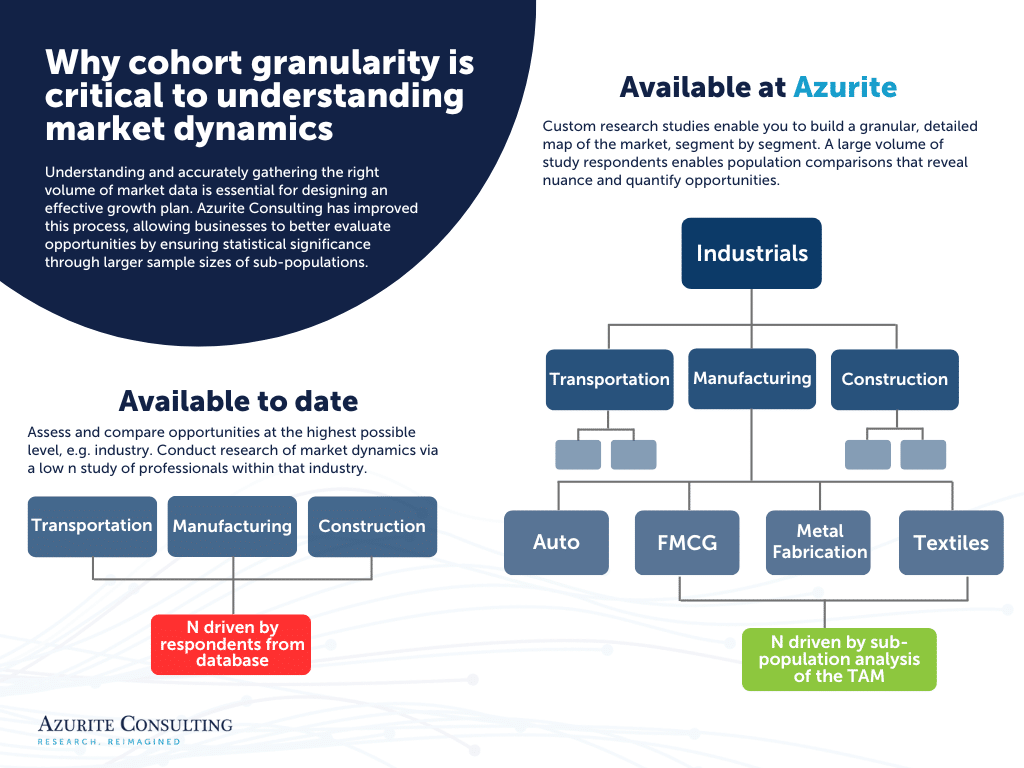

When you’re sizing the market, small details make a big difference. If you’re using secondary reporting or customer data supplied by the target—or if the population you survey is too narrow—your view of the market will be skewed. This can lead you to miss crucial insights about specific segments.

By contrast, custom research studies enable you to build a more granular, detailed map of the market, segment by segment. By comparing the data from different sub-populations that you’ve surveyed, you’ll gain a deeper and more sophisticated understanding of market boundaries. You’ll also get a more sophisticated understanding of specific potential customer groups, expand the definition of your ICP and measure:

- Whether the market break down into different niches and, if so, identify the cutoff points, along with how customer pain points, needs, and decisions vary between them.

- If there are profitable points of intersection where, for example, companies of a specific size and geography are especially underserved.

Capturing data at deep levels of granularity, in volumes that enable accuracy, allows you to identify exactly how a potential investment will deliver or how your portfolio company will unlock growth.

Craft an In-Depth Product Roadmap

Best-in-class B2B research doesn’t just deliver a clearer and more detailed view of market opportunities. It also helps you build a data-driven roadmap of how to pursue those opportunities—and what needs to be done to capture the full value of an investment or increase portfolio profitability.

It starts with a deep dive into customer pain points, latent needs, and competitor strengths. Gather accurate data from existing customers, churned customers, and competitive customers to measure:

- How do your target’s offerings fit into the competitive landscape, and what steps might be taken to make them more profitable?

- What is the value of addressing different customer pain points? Would people pay for new features, product/service improvements, or consolidated offerings?

- What factors have the most impact on sales?

Armed with answers to these major strategic questions based on custom market intelligence, you can then construct an investment roadmap that’s specific, comprehensive, and grounded in real insights and data from yours and your competitor’s ICPs – or go pencils down if the effort isn’t worth it.

The Bottom Line

- In a volatile deal environment, high-quality, custom primary research equips PE firms with the insights needed to swiftly assess market potential, seize the right opportunities, and enhance the value of existing investments.

- Measuring TAM from the ground up, with significant data by sub-segment, quantifies the needs and actionable growth strategies to deliver future value – during deals and for portfolio companies.

- Proprietary data and market intelligence can now be collected in volumes and levels of granularity that weren’t previously possible to achieve, enabling greater insight, earlier on – to reduce downside risk and unlock significant value.

Reimagining Research

Quality decision making starts with quality data. Azurite Consulting was founded by ex-McKinsey consultants, and we understand the fast pace and razor-sharp insights that PE firms demand. That’s why we’ve optimized our process to the PE timeline. The top Private Equity, Hedge Funds, Consulting Firms and Enterprise leaders have already seen the difference Azurite can make on their business. Contact Azurite to learn more about how we can take your B2B research to the next level.

Azurite Consulting is the only full-service research firm that recruits every respondent from scratch using our in-house team and machine learning methods. Our unique methodology and unparalleled data quality sets us apart from other providers.

Speak to Our Team

Follow Us

Read More Azurite Insights for Private Equity