A lot can go wrong when it comes to B2B research. Do any of the following scenarios sound familiar?

- When digging into the research data, you become concerned about anomalies

- Your research provider tries to reduce your expectations by claiming that there “aren’t enough” decision-makers in the market or, even worse, they overpromise respondents and then can’t deliver

- Your market research “results” feel like canned answers to generic questions, not laser-focused insights on your toughest business challenges

- You’ve spent hours reformatting data files to try to identify real insight

Bad data is not a normal byproduct of B2B research. It’s a sign that something’s gone wrong—and it’s usually related to the fact that most research firms outsource at least one of the many steps it takes to deliver meaningful insight.

Outsourcing tasks like survey recruitment or coding may seem like a natural way to streamline the research workflow (or find more respondents). In reality, it threatens the integrity of your results—and the whole project.

By contrast, maintaining a fully integrated research process (a term we’ve created to describe a new workflow that maintains tight control from start to finish) can deliver greater efficiency while improving the integrity of the research, insights, and outcomes—ultimately leading to significantly greater ROI. Here’s why.

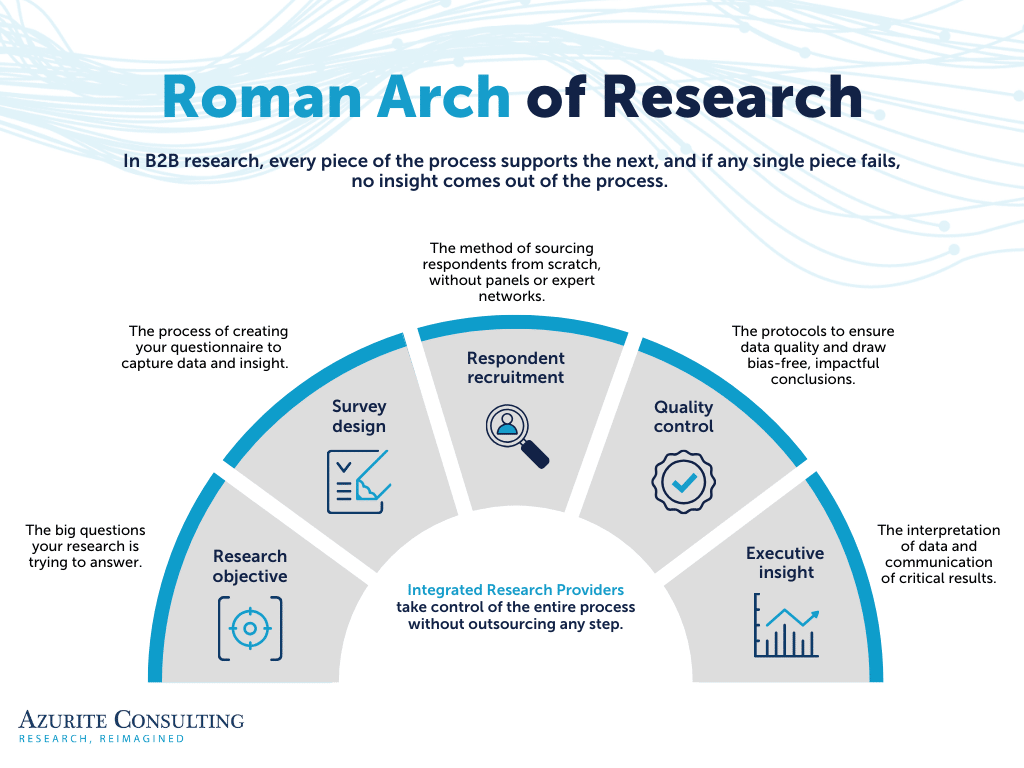

The Roman Arch: How an Integrated Research Provider Delivers Quality Results

B2B research is like a Roman arch—each piece supports the next, and if any single piece fails, the entire structure crumbles—meaning, no insight comes out of the process and all of your efforts. Integrated Research Providers build their workflow around this reality, controlling and integrating every step from start to finish to deliver unique market data and insight you can rely on to make decisions .

An Integrated Research Provider takes a different, unique approach to each step of the research process. Most importantly, they keep all of the steps in-house to maintain full control.

It’s worth highlighting a few of the most unique—and consequential components—of this methodology. Integrated Research Providers recruit respondents without panels or expert networks. Instead, they go directly to the market, collecting responses from all relevant cohorts. That enables them to deliver a substantially greater number of high-quality responses—invaluable data that can deliver market share insight and be “subcut,” all while remaining statistically significant.

Integrated Research Providers also manage the entire survey design and quality control process, in-house, to eliminate biases and skews. The result of this methodology is the highest-quality data in the market research industry that reliably delivers actionable insight to your investment committees and executive teams.

Bad Data, Lackluster Insights: The Pitfalls of Disaggregating Research

What happens when providers don’t use a fully integrated research process? Many PE firms utilize expert networks, panels, and aggregators to supply market research and analysis. What they don’t realize is that sourcing data from these types of firms introduces all kinds of anomalies into their results and findings.

That’s because expert networks and panels have disaggregated the research workflow, outsourcing some of the most critical tasks to third parties, then combining them into “findings” that are crude, disjointed, skewed and ultimately unreliable.

Here are a few of the consequences of disaggregating research:

- You won’t be able to trust your data: It’s hard to trust “insights” that were generated by the same tired group of recycled “experts”—especially when you can’t even verify that those experts are the decision makers they claim to be, or retired years ago. When you work with a disaggregated provider, you’ll never know how your data maps onto the market, because you’ll never understand what skews were introduced by the database itself (not to mention the biases that crept in through poorly worded questions). Quality Control is often overly simplistic, if it’s there at all, leaving room for “straight-liners” (respondents who give identical or near identical answers to each question) and even fraudulent respondents who make their way into your dataset.

- You’ll miss the most relevant insights: If your research provider didn’t gather the data, chances are, they will struggle to see what it says and understand the impact of all the other ‘arch’ steps on the findings. You can do it yourself—but that takes time, and you might miss meaningful insights about more complex topics like subpopulations and decision drivers–and you too may miss ‘hidden skews’ if you don’t exactly know how each respondent was identified for your study.

- You’ll work harder for less value: In an industry where strategic intelligence can make or break the success of multi-million-dollar investments, it pays to be smart about your return on research. Many PE firms rely on multiple providers to research different industries. That might seem like best practice, but it actually increases workload both on a project basis and over time. Each provider will be following their own, likely different processes, making you the one who has to learn and track their nuances. And if your team has the burden of coordinating 15 different suppliers on a single research project, the likelihood is high that something will fall through the cracks.

How to Find a Research Partner You Can Trust

The right research partner has the breadth, depth, and experience to act like an extension of your internal research team, serving as a trusted thought partner while expanding the scope and sophistication of the projects they take on.

Some tips to determine if a firm is an integrated provider and is capable of meeting your needs:

- They focus on research outcomes, not just process and respondents: An integrated provider will be able to speak intelligently about your goals and how they impact research design, not simply rattle off their own process. They understand that the goal of market research is to provide data-backed answers to amorphous intellectual problems—and they know how to extract insights from the data that address real business problems.

- They always recruit fresh study respondents and never turn to expert networks, panels, or aggregators: It matters where and how your provider recruits survey participants. Firm that recruits from scratch rather than a from a database can deliver an accurate picture of the whole market, not just a snapshot from their network or is skewed based on which networks were aggregated and the types of respondents that chose to join a network.

- They manage every step in-house: Integrated providers understand the value of controlling the research process from end to end. If your provider is outsourcing any component, they’re opening your results up to weaknesses you can’t prepare for. Make sure your provider is undertaking each step of the Roman Arch in-house.

- They give clear, compelling answers to methodological questions rather than dodging or avoiding them: There are questions you can ask your market researcher that will reveal their capability to deliver on your objectives. If they can’t adequately answer to your satisfaction, they will surely disappoint when it comes to your research.

Market research is an extraordinarily valuable tool for Private Equity firms to leverage, from diligence research to value enhancement for portfolio companies. That’s why it’s so critical to make sure your market research provider can deliver what you need to make crucial investment decisions: a data-driven perspective that the market doesn’t already have.