Thriving in low-volume markets: Market intelligence strategies that move the needle

Private Equity deal volume remains at historic lows, with few attractive targets and continued excessive dry powder. Though recovery appears to be on the horizon, according to PitchBook estimates, 2024’s Q1 & Q2 deal counts remain depressed, with deal close rates at all-time lows.

Winning in this environment requires firms to reimagine their approach from deal to portfolio. In particular, teams must seek a fast, accurate, and comprehensive view of market potential so they can move quickly on any opportunities that do arise—while also putting the current portfolio under a magnifying glass to find growth pathways.

Azurite Consulting has deep experience supplying actionable business intelligence on PE timelines. In this article, we’ll share three essential market intelligence strategies that we use to help top mid-market and large cap firms quickly pinpoint when to either lean in or go pencils down on underwritable deals as well as how to capture value within their existing portfolio.

Understand the Potential of All Untapped and Competitive Segments

Smart research doesn’t cut corners even when decision makers are too difficult to reach. Instead, it meticulously encompasses the entire addressable market to uncover, evaluate and size the broadest set of opportunities. it provides strong validation for or against investment theses.

The best way to ensure complete coverage? By talking to a comprehensive pool of potential buyers—from soon-to-be adopters to competitors’ customers—and building their perspectives into your growth hypotheses, market sizing, and, ultimately, valuation. This will enable you to answer questions like:

- How does your target or portfolio company’s sweet spot vary by industry, customer type, or other relevant factors?

- How could you incentivize companies that still rely on homebuilt solutions to come on board?

At Azurite, we call this getting the “Voice of the Total Addressable Market”—and we’ve seen it deliver results at both the deal-making and portfolio value creation stages, arming firms with powerful insights and trustworthy data about both current and future opportunities.

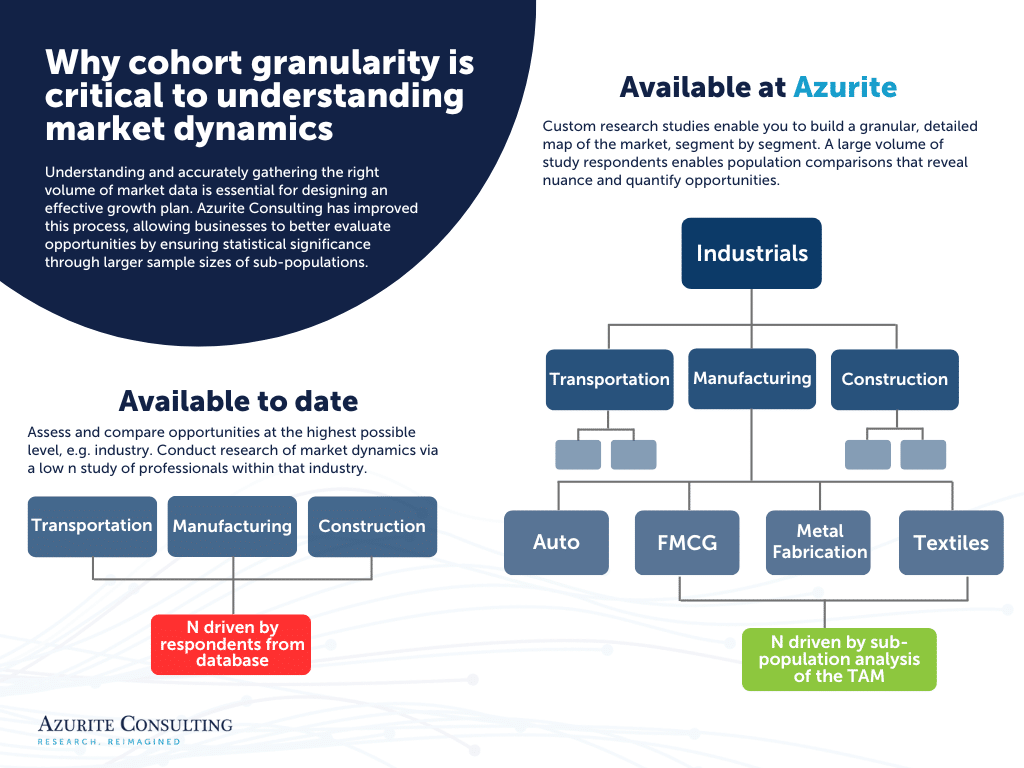

Measure Market Intelligence From the Ground Up, in Granular Detail

When you’re sizing the market, small details make a big difference. If you’re using secondary reporting or customer data supplied by the target—or if the population you survey is too narrow—your view of the market will be skewed. This can lead you to miss out on crucial insights about individual segments.

By contrast, custom research studies enable you to build a more granular, detailed map of the market, segment by segment. By comparing the opinions of different sub-populations that you’ve surveyed, you’ll gain a deeper and more sophisticated understanding of market boundaries. You’ll also get a more sophisticated understanding of specific potential customer groups, expand the definition of your ICP and answer questions like:

- Does the market break down into different niches? If so, where are the cutoff points, and how do customer pain points, needs, and decisions vary between them?

- Are there profitable points of intersection where, for example, companies of a specific size and geography are especially underserved?

Assessing these dynamics enables you to clarify exactly what a proposed investment will deliver or what course your portfolio company needs to chart to grow its customer base.

Craft an In-Depth Product Roadmap

Best-in-class B2B research doesn’t just deliver a clearer and more detailed view of market opportunities. It also helps you build a data-driven roadmap of how to pursue those opportunities—and what needs to be done to capture the full value of an investment or increase the profitability of your portfolio company.

It starts with a deep dive into customer pain points, latent needs, and competitor strengths. Gather accurate data from existing customers, churned customers, and competitive customers to understand things like:

- How do your target’s offerings fit into the competitive landscape, and what steps might be taken to make them more profitable?

- What is the value of addressing different customer pain points? Would people pay for new features, product/service improvements, or consolidated offerings?

- What factors have the most impact on sales?

Then, you can construct a product roadmap that’s specific, comprehensive, and grounded in real insights from the people who matter most. If capturing value from an investment is going to cost more than it’s worth, you’ll know it’s time to go pencils down on the deal. If the needs of an investment can be squared against its growth potential, you’ll be able to quantify exactly how much you can spend before the numbers stop adding up.

The Bottom Line

- In a low-deal environment, high quality, custom primary research helps PE firms understand market potential so they can move quickly on a more limited set of opportunities—and bolster the value of current investments.

- Quantifying all angles of future growth provides strong validation for or against investment theses.

- Measuring TAM from the ground up, with significant data by sub-segment, quantifies the exact investments needs and growth strategies to deliver future value.

Reimagining Research

Quality decision making starts with quality data. Azurite Consulting was founded by ex-McKinsey consultants, and we understand the fast pace and razor-sharp insights that PE firms demand. That’s why we’ve optimized our process to the PE timeline. The top Private Equity, Hedge Funds, Consulting Firms and Enterprise leaders have already seen the difference Azurite can make on their business. Contact Azurite to learn more about how we can take your B2B research to the next level.

Azurite Consulting is the only full-service research firm that recruits every respondent from scratch using our in-house team and machine learning methods. Our unique methodology and unparalleled data quality sets us apart from other providers.

Speak to Our Team

Follow Us

Read More Azurite Insights for Private Equity