Navigating Prolonged Exits: How Investors are Leveraging New Intel to Accelerate Exit Value & Velocity

Private Equity firms face increasing pressure and competition to deliver returns to their investors. Yet according to PitchBook research, exits are taking longer than ever.

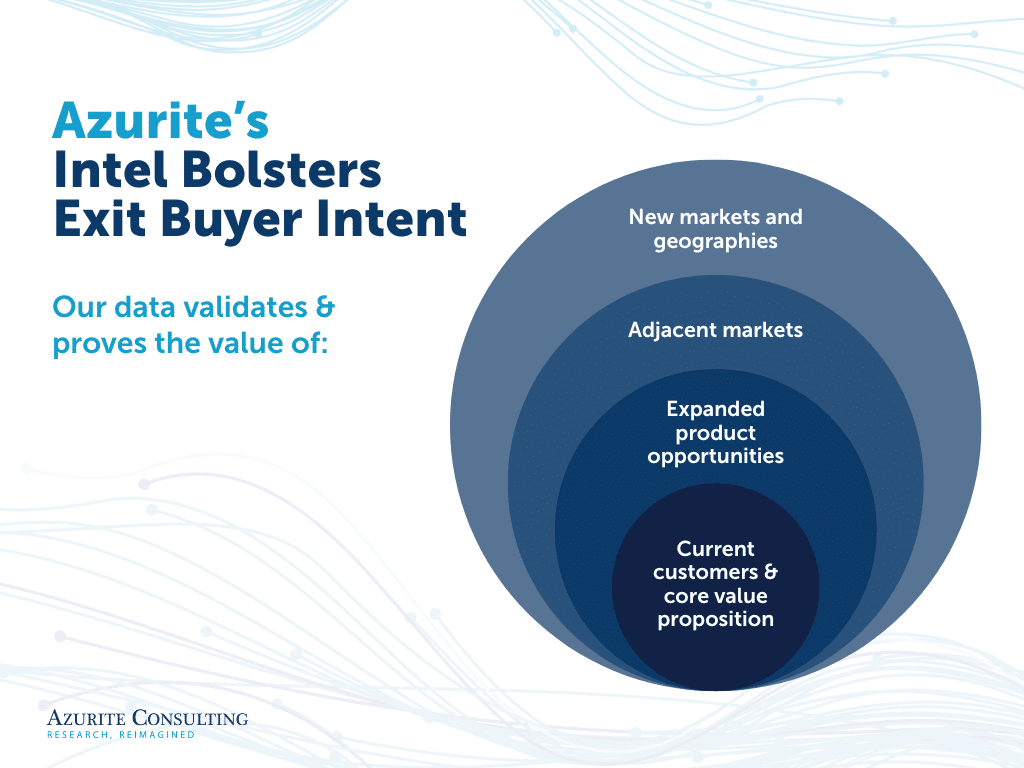

To buck this trend, leading investors are using new and innovative market intelligence tools to bolster exit potential and boost IRR. The industry is awash in data. Yet firms still struggle to cut through the noise to find the credible information to underpin valuation and growth projections – and to accelerate exit velocity.

Azurite Consulting has deep experience helping PE firms and investors expedite transactions, improve diligence outcomes, and develop portfolio company strategy. In this article, we’ll review how the most successful companies are leveraging cutting-edge market intelligence to valuations and maintain target exit timing.

Prove Value: Uncover and Accurately Size New & Adjacent Markets

Taking existing products into new markets can demonstrate growth opportunity before an exit, but proving that there’s value before entering new markets and crafting winning strategies is a challenge without the right information. The expert networks that PE firms typically utilize can miss the mark(et), since they include only a limited subset of individuals—this leaves blind spots and forces firms to roughly triangulate TAM and opportunity sizing.

Azurite’s cutting-edge data capture and research methodologies help investors gather intelligence to discover new markets (e.g. new verticals) and accurately size and target these underserved and untapped opportunities. These insights also quantify how products will align with B2B buyer needs and assess the best strategies for both entry and future growth.

As an example, a top, middle market PE firm’s portfolio included an electronic document management solution. The company was already a market leader in the legal industry. To accelerate their exit, the firm wanted to explore the marketability of the software in new sectors, like real estate and healthcare. They partnered with Azurite to conduct market research that would help assess this potential strategy using real-world data.

Azurite ran two concurrent studies. One targeted decision-makers in real estate, while the other targeted healthcare executives. The studies delivered market-shaped answers to questions like: who are the major players, and how firmly are they entrenched (i.e. market penetration)? What features are most essential to customers, and how much are people willing to pay for them?

The data told a clear story—the existing software could easily be adapted to new industries. Real estate was an attractive opportunity and pursuing it would require only minimal changes to the company’s software and sales process. In contrast, the healthcare market was already dominated by a major player that would be difficult to dislodge.

Our growth roadmap, supported by customized data, outlined specific pathways and strategies to unlock future expansion opportunities. This not only solidified the business case for expansion but also enhanced the company’s appeal to a broader range of buyers, fostering increased competition and value creation for the seller.

Prove the Product Roadmap Aligns with Buyer Expectations to Drive Value

To drive a successful exit, sellers need to provide clear evidence that their existing market still has ample untapped growth opportunities. The right custom research will deliver indisputable data to make forecasted growth opportunities indisputable.

A leading, large cap PE firm recently approached Azurite for help with an education software company that was well-penetrated in the elementary school market. Was there an opportunity beyond elementary school and in new geographies —perhaps in the middle or high school markets or new states?

Azurite captured data and intelligence from hundreds of decision makers who typical market research providers would not be able to reach—from teachers and administrators to superintendents and curriculum advisors—to build a data-driven case for potential buyers. This research addressed a range of questions to reduce risk for the potential buyer: How did buyer and user needs differ in secondary education markets vs. elementary? Was there a real need for the product in the middle and high school markets? Could the existing product penetrate? What adaptations and features would be required to compete, and how much should be charged?

The data and intelligence delivered, validated the seller’s roadmap and helped drive a rapid and competitive exit for the seller, with a valuation premium that exceeded the firm’s expectations by 125%.

The Bottom Line

- Innovative market intelligence tools fast-track and bolster exits, by providing credible and reliable data that uncovers and quantifies the full addressable market, inclusive of new verticals and adjacent markets.

- The best and most robust intelligence is market-shaped and provides the data to validate how product roadmaps will deliver against projected valuations and buyer expectations, bolstering buyer intent, certainty and comfort with the deal.

- Cutting-edge market intelligence methods ensure that the seller’s forecast profitability and growth potential are underpinned by real and credible data to drive transactions forward.

- Azurite Consulting supports the largest global PE investors, delivering innovative and unique market intelligence tools, to accelerate portfolio growth and boost exit valuations and velocity.

Reimagining Research

Quality decision making starts with quality data. Azurite Consulting was founded by ex-McKinsey consultants, and we understand the fast pace and razor-sharp insights that PE firms demand. That’s why we’ve optimized our process to the PE timeline. The top Private Equity, Hedge Funds, Consulting Firms and Enterprise leaders have already seen the difference Azurite can make on their business. Contact Azurite to learn more about how we can take your B2B research to the next level.

Azurite Consulting is the only full-service research firm that recruits every respondent from scratch using our in-house team and machine learning methods. Our unique methodology and unparalleled data quality sets us apart from other providers.

Speak to Our Team

Follow Us

Read More Azurite Insights for Private Equity